Dental Practice Cash Flow Projection: How To Guide (2026)

How to Build a Dental Practice Cash Flow Projection

Creating a dental practice cash flow projection means laying out, month by month, how cash will come into the practice and how it will be spent. The goal is not to estimate profit, but to understand whether the practice will have enough cash on hand to cover payroll, rent, loan payments, and other obligations at all times.

Below is a practical walkthrough of how dental practices typically build a cash flow projection.

Step 1: Set Up General Assumptions and Startup Funding

Start by defining the foundation of the practice.

This includes:

- Equity invested (personal funds, partners, or family)

- Loan details such as SBA loan amount, interest rate, term, and first payment month

- Fixed assets like build-out, dental equipment, imaging machines, furniture, and IT

- Starting inventory and initial cash balance

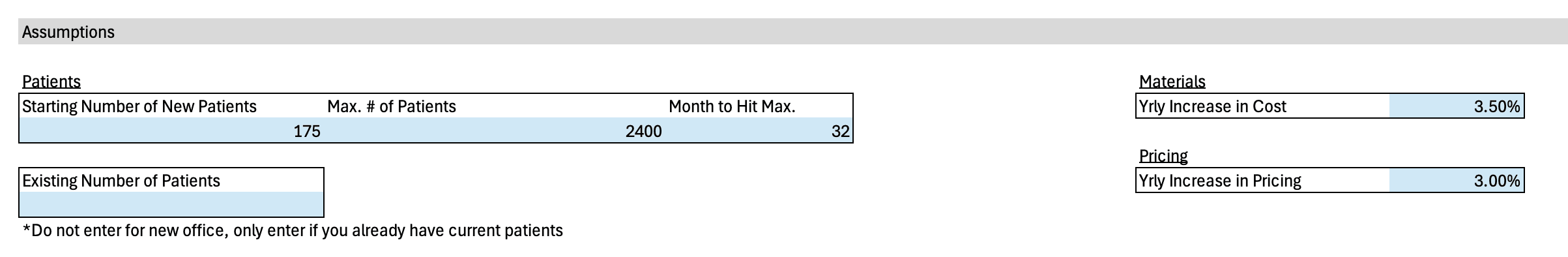

Step 2: Project Patient Growth Over Time

This step establishes how much cash the practice begins with and how much debt it must service before seeing steady patient volume.

Instead of guessing revenue directly, start with:

- Starting number of patients

- Maximum patient capacity

- Number of months it takes to reach that capacity

This creates a realistic ramp-up period for a new or expanding dental office. Most practices do not reach full volume immediately, and modeling this growth curve prevents overstating early cash flow.

Step 3: Build Revenue From Services Per Patient

Once patient volume is projected, revenue is built from services.

For each service:

- Enter the average fee

- Enter material or supply cost

- Estimate how often the average patient receives that service per year

Common services include exams and cleanings, X-rays, fillings, crowns, and other procedures. When combined, this produces an average annual spend per patient, which then drives monthly revenue.

Insurance reimbursement assumptions are layered on to reflect what percentage of billed fees are actually collected.

Step 4: Model Labor Costs in Detail

Labor is usually the largest expense in a dental office, so it must be modeled carefully.

Hourly staff assumptions include:

- Hours open per week

- Extra opening and closing hours

- Minimum staff per hour

- Average hourly wage

- Wage inflation over time

Salary employees are modeled separately, including:

- Associate dentists

- Office managers

- Owners taking a salary (you)

- Start month, taxes, and annual raises

This structure ensures payroll grows in line with patient volume instead of jumping unrealistically.

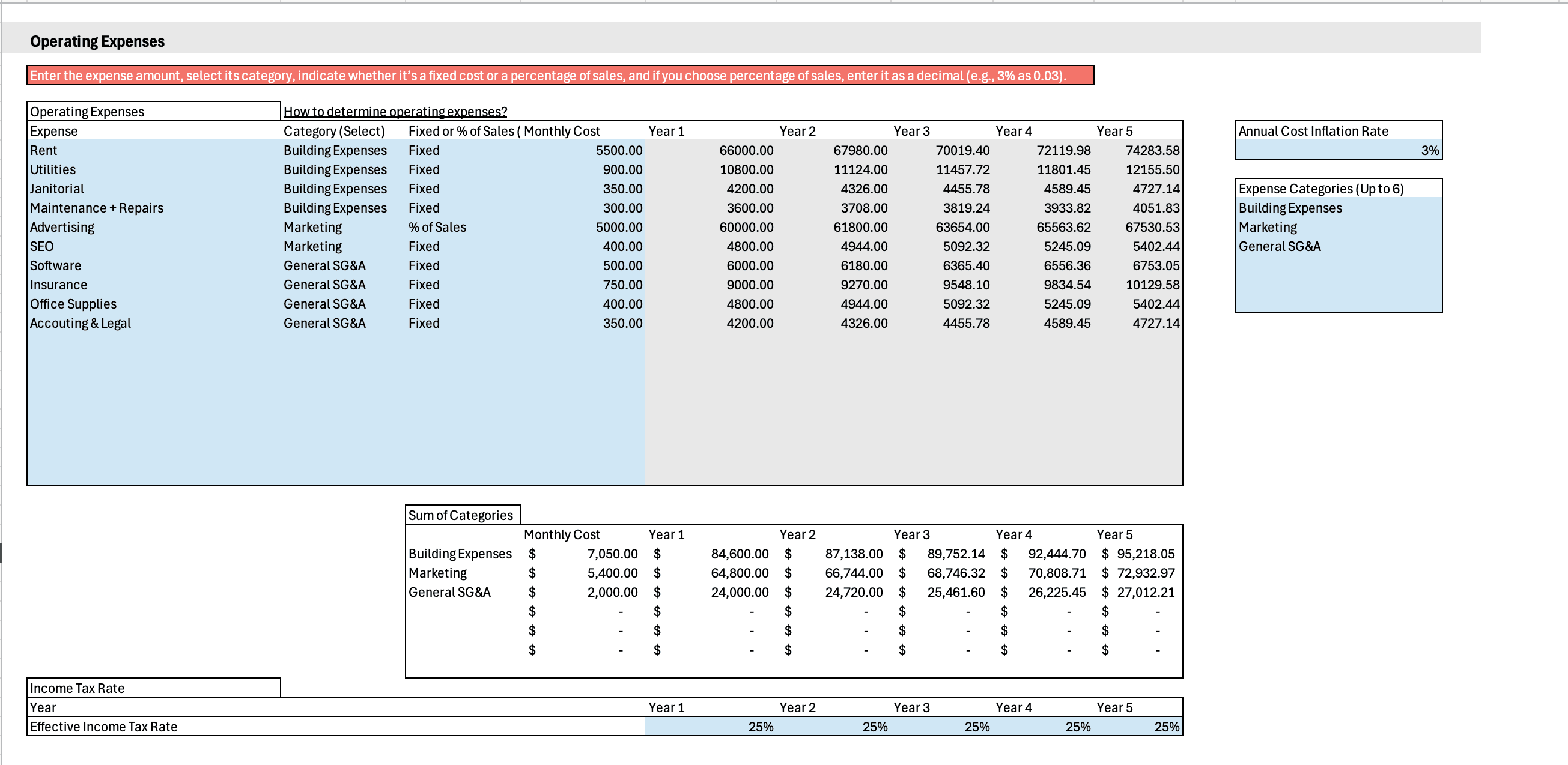

Step 5: Add Operating Expenses

Operating expenses are entered next and categorized for clarity.

Typical expense categories include:

- Building expenses (rent, utilities, janitorial, repairs)

- Marketing (advertising, SEO, patient acquisition)

- General SG&A (software, insurance, office supplies, accounting)

Step 6: Account for Owner Distributions

Owner distributions are layered in after operating costs.

Modeling distributions after expenses helps prevent over-paying owners in early months when cash is still stabilizing.

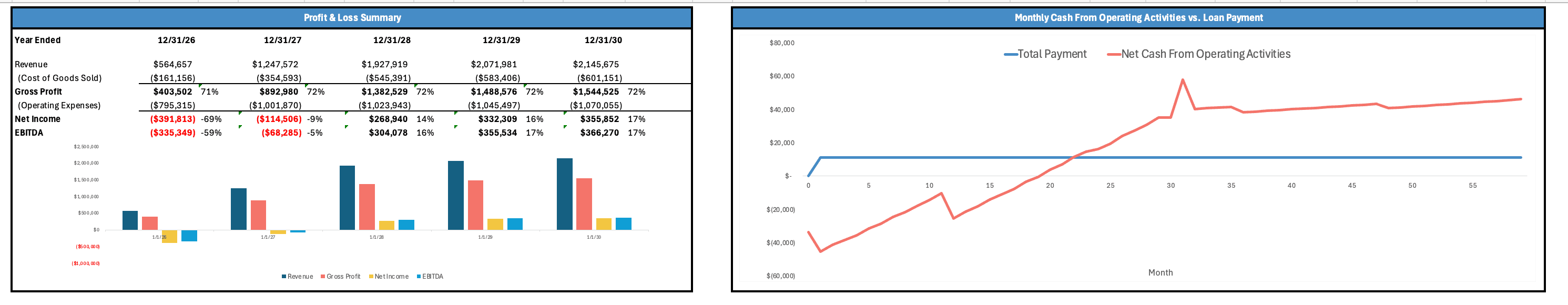

Final Product

Heres what we get after filling out the template

Dental Office Financial Projection Template (Excel/Google Sheets)

Get the template we used

Ready to Create Your Financial Model?

Get professional, investor-ready financial projections with our industry-specific templates. Save time and secure funding faster.

Browse Financial Models →