How to Create an Income Statement for a Dental Office (Step-by-Step Guide)

If you’re opening a dental practice, buying an existing office, or preparing for an SBA loan or investor conversation, one of the most important financial documents you need is a dental office income statement.

An income statement shows whether your practice actually makes money. More importantly, it helps you understand why it does or doesn’t.

In this guide, we’ll walk through how to build a dental office income statement from scratch, what numbers to include, and common mistakes dentists make when projecting profitability. At the end, we’ll show how to save hours of work using a pre-built, investor-ready template.

What Is an Income Statement for a Dental Office?

An income statement (also called a profit and loss statement) summarizes your dental practice’s:

- Revenue

- Operating Expenses

- Profit before and after taxes

Most dental income statements are prepared monthly and annually, especially for:

- SBA loans

- Bank financing

- Practice purchases

- Cash flow planning

Unlike a balance sheet, the income statement focuses on performance over time, not what you own or owe.

Step 1: Project Dental Office Revenue

Revenue is the top line of your income statement and should be broken out clearly.

Common Dental Revenue Categories

Most dental practices earn revenue from a mix of:

- Preventive care (cleanings, exams, X-rays)

- Restorative procedures (fillings, crowns, bridges)

- Major procedures (implants, oral surgery, orthodontics)

- Cosmetic dentistry (whitening, veneers)

Instead of using one total revenue number, it’s better to project revenue using production drivers, such as:

- Patients per day

- Average revenue per visit

- Operating days per month

This approach creates more realistic projections and makes it easier to explain your numbers to lenders.

Step 2: Calculate Cost of Goods Sold (COGS)

COGS includes the direct costs required to deliver dental services.

Typical dental COGS include:

- Dental supplies and consumables

- Lab fees

- Impression materials

- Crowns, implants, and prosthetics

For most dental practices, COGS usually ranges from 6% to 10% of revenue, depending on procedure mix. Your income statement should subtract COGS from revenue to arrive at gross profit.

Step 3: List Dental Office Payroll Expenses

Payroll is usually the largest expense for a dental practice.

Common Payroll Roles

- Dentist or owner compensation

- Dental hygienists

- Dental assistants

- Front desk and office manager

Payroll should include:

- Wages and salaries

- Payroll taxes

- Benefits

When building projections, it’s important to:

- Separate hourly vs salaried employees

- Account for raises over time

- Match staffing levels to patient volume

Many dentists underestimate payroll growth, which leads to overly optimistic profit forecasts.

Step 4: Add Operating Expenses

Operating expenses keep the practice running but are not directly tied to patient procedures.

Typical Dental Operating Expenses

- Rent or mortgage

- Utilities

- Practice management software

- Insurance

- Marketing and advertising

- Office supplies

- Professional fees

These costs are usually modeled monthly and adjusted annually for inflation.

After subtracting operating expenses from gross profit, you arrive at operating income.

Step 5: Include Taxes and Owner Compensation

Finally, account for:

- Income taxes

- Owner distributions or salary

The structure here depends on whether the practice is an LLC, S-Corp, or sole proprietorship. Even if you’re early-stage, it’s important to include reasonable owner pay to avoid overstating profitability.

After taxes, you’ll reach net income, the bottom line of your dental office income statement.

Common Mistakes When Building a Dental Income Statement

Many first-time practice owners make the same errors:

- Using a single revenue number with no assumptions

- Forgetting lab fees and variable supply costs

- Underestimating payroll and staffing needs

- Ignoring inflation and annual raises

- Not structuring the statement in a lender-friendly format

These mistakes can cause loan rejections or cash flow surprises after opening.

A Faster Way: Use a Dental Office Income Statement Template

Building a dental income statement from scratch in Excel can take hours and still leave room for errors.

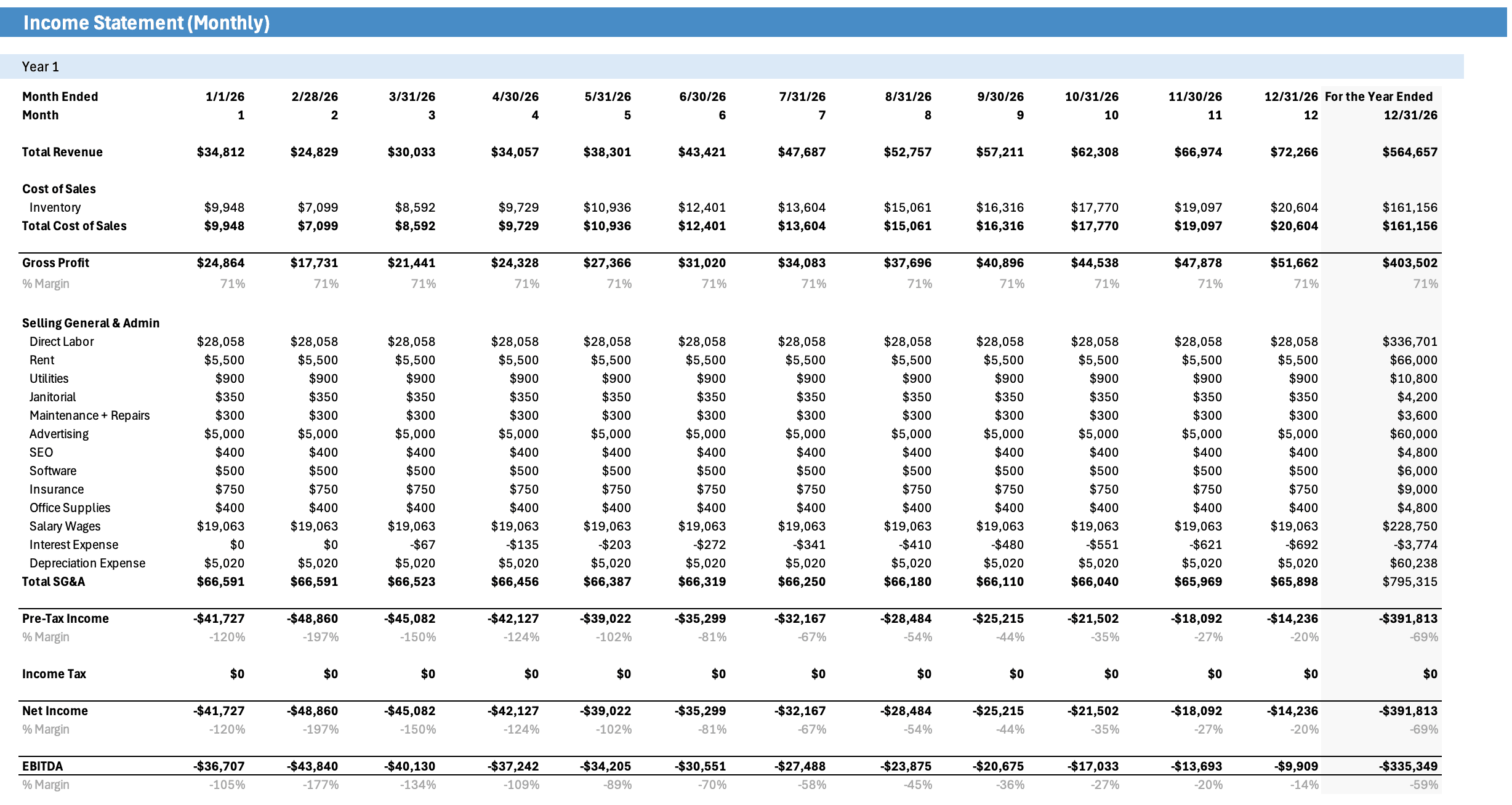

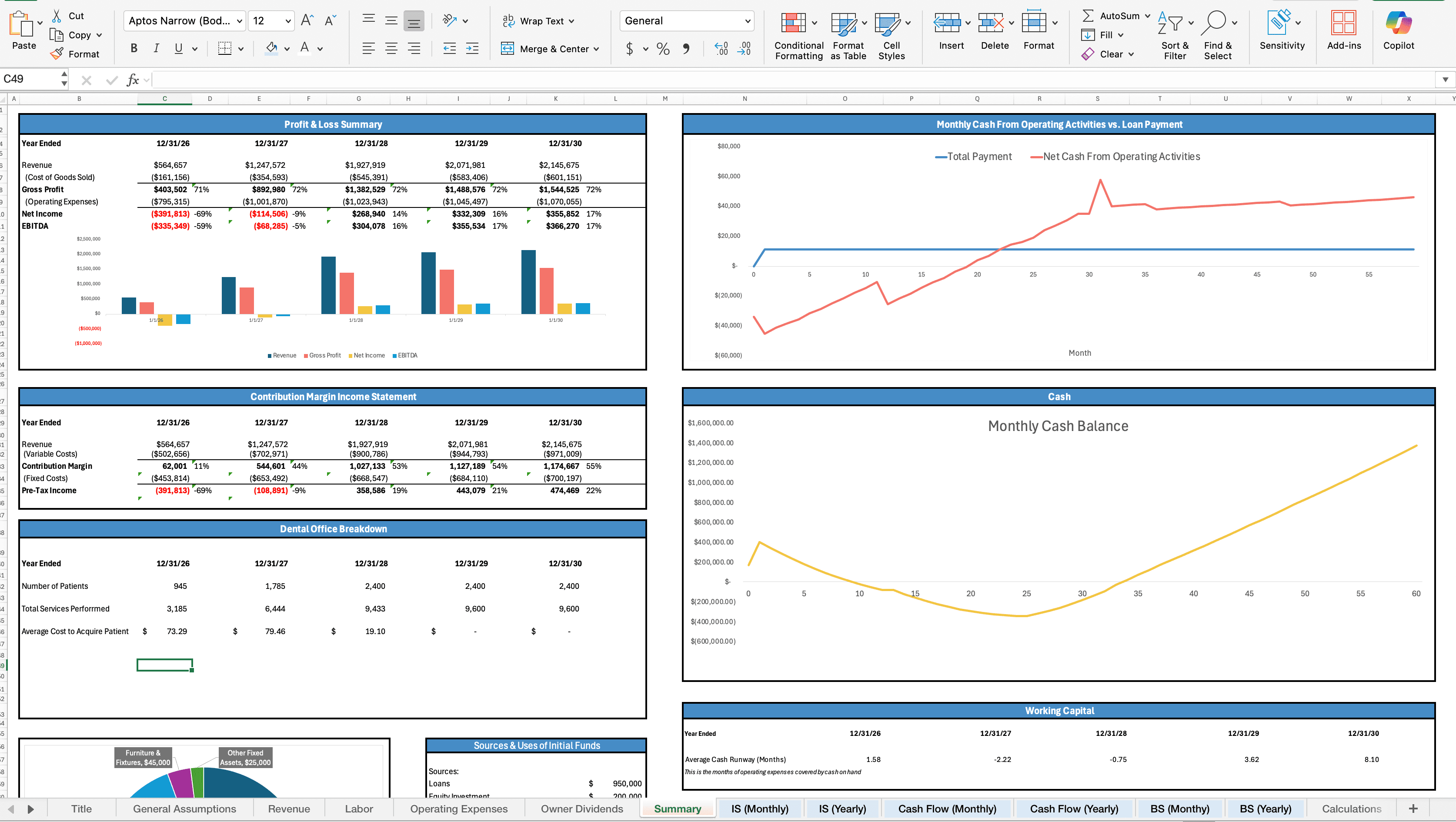

That’s why we created a Dental Office Financial Projection Template that includes:

- A fully built income statement

- Pre-filled industry-average assumptions

- Monthly and annual projections

- Editable revenue drivers and expense categories

- SBA and investor-ready formatting

Instead of guessing formulas, you can focus on adjusting assumptions to match your specific practice.

If you’re serious about opening, buying, or scaling a dental office, a clean, realistic income statement is non-negotiable. Our template gives you a professional starting point without the headache of building everything yourself.

Dental Practice Projection Template - 5 Year Model

Ready to Create Your Financial Model?

Get professional, investor-ready financial projections with our industry-specific templates. Save time and secure funding faster.

Browse Financial Models →