How to Forecast Cash Flow for a Food Truck? (2026)

Before you launch your food truck, one of the most critical steps you can take is projecting your cash flow. You might have a killer menu, a loyal local following, and a great truck setup, but without proper cash-flow planning, even profitable food trucks can fail because they run out of cash.

Cash flow determines whether you can pay for ingredients, staff, licenses, repairs, and other operating costs as sales ramp up. This guide walks through what you need to think about when projecting cash flow for a food truck in 2026.

What Cash Flow Means for a Food Truck

Cash flow is simply the movement of money into and out of your business:

- Cash inflows include daily food and drink sales, catering revenue, event fees, and merchandise.

- Cash outflows include food costs, payroll, fuel, permits, repairs, vendor payments, insurance, and more.

Your goal isn’t just to be profitable on paper, it’s to always have enough cash in the bank to operate and respond to sudden costs. Even a food truck with strong sales can get stuck if expenses hit before revenue is collected.

Initial Startup Funding & Cash Buffer

Before projecting monthly cash flow, start with your initial investment:

- Owner capital you’re putting in

- Loans or financing you’ve secured

- Grants or investor capital

This becomes your starting cash balance, the runway you have before your food truck begins making enough cash from daily operations to cover expenses.

In addition to startup costs, you need a cash buffer, extra money set aside to cover slow periods, unplanned repairs, or fluctuations in sales. Most food trucks don’t generate positive net cash right away, so it’s wise to assume a few months of negative cash flow before revenue stabilizes.

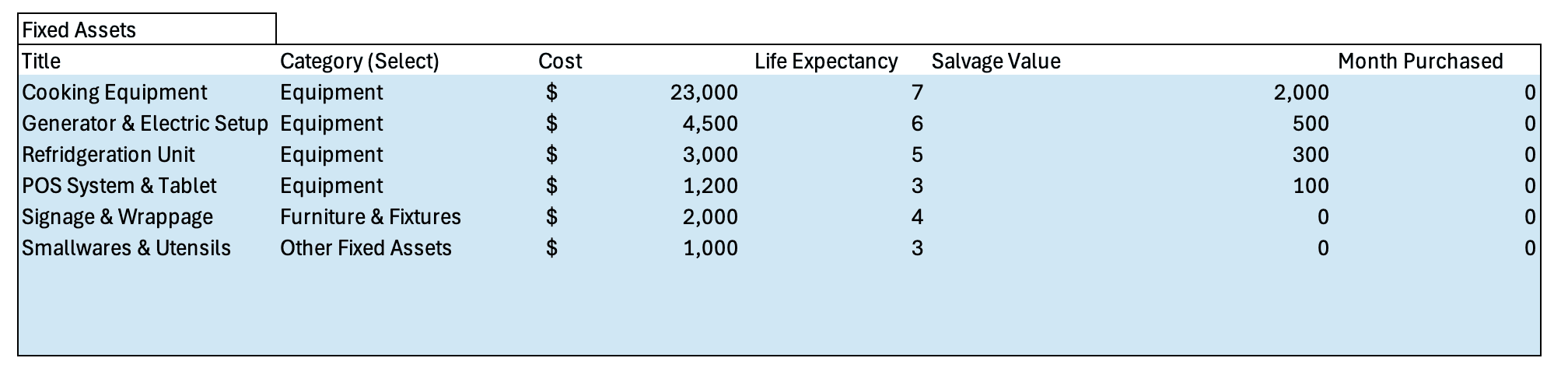

Startup Costs to Include

Food truck startup costs can vary widely, but typical items you should include in your cash flow model are:

- Purchasing or leasing the truck

- Kitchen equipment and build-out

- Permits, licenses, and inspections

- Initial inventory (ingredients, packaging)

- POS systems and software

- Initial marketing and signage

- Professional fees (legal, accounting)

Make sure you capture all upfront cash outflows in your projection so you know how much cash you need before opening day.

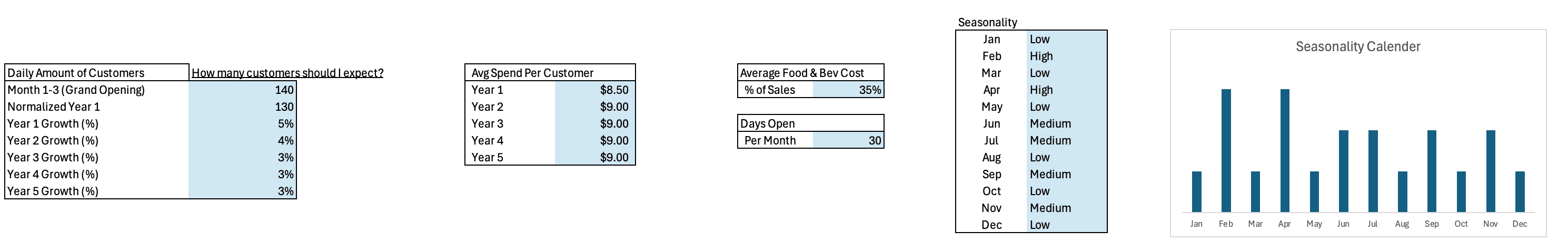

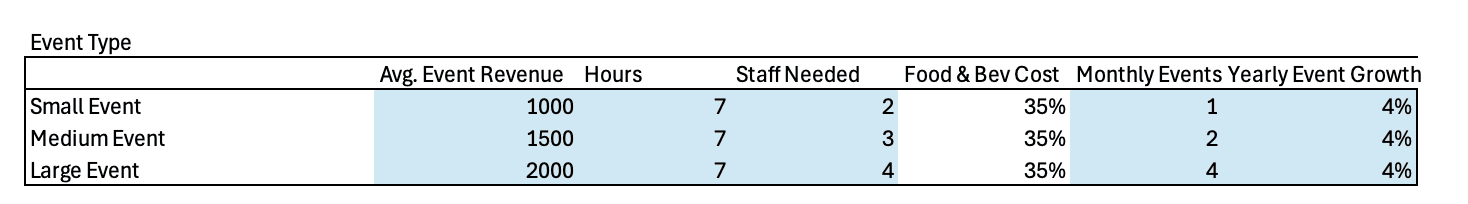

Estimating Revenue: Realistic Is Better Than Optimistic

When projecting sales for your food truck, build realistic assumptions around:

- Average ticket (how much a customer spends per visit)

- Customers per day

- Operating days per week

- Seasonality (weekend events, festival seasons, weather patterns)

- Event vs. daily route revenue

It’s better to underestimate revenue and be pleasantly surprised than to overestimate and run out of cash because inflows came slower than expected.

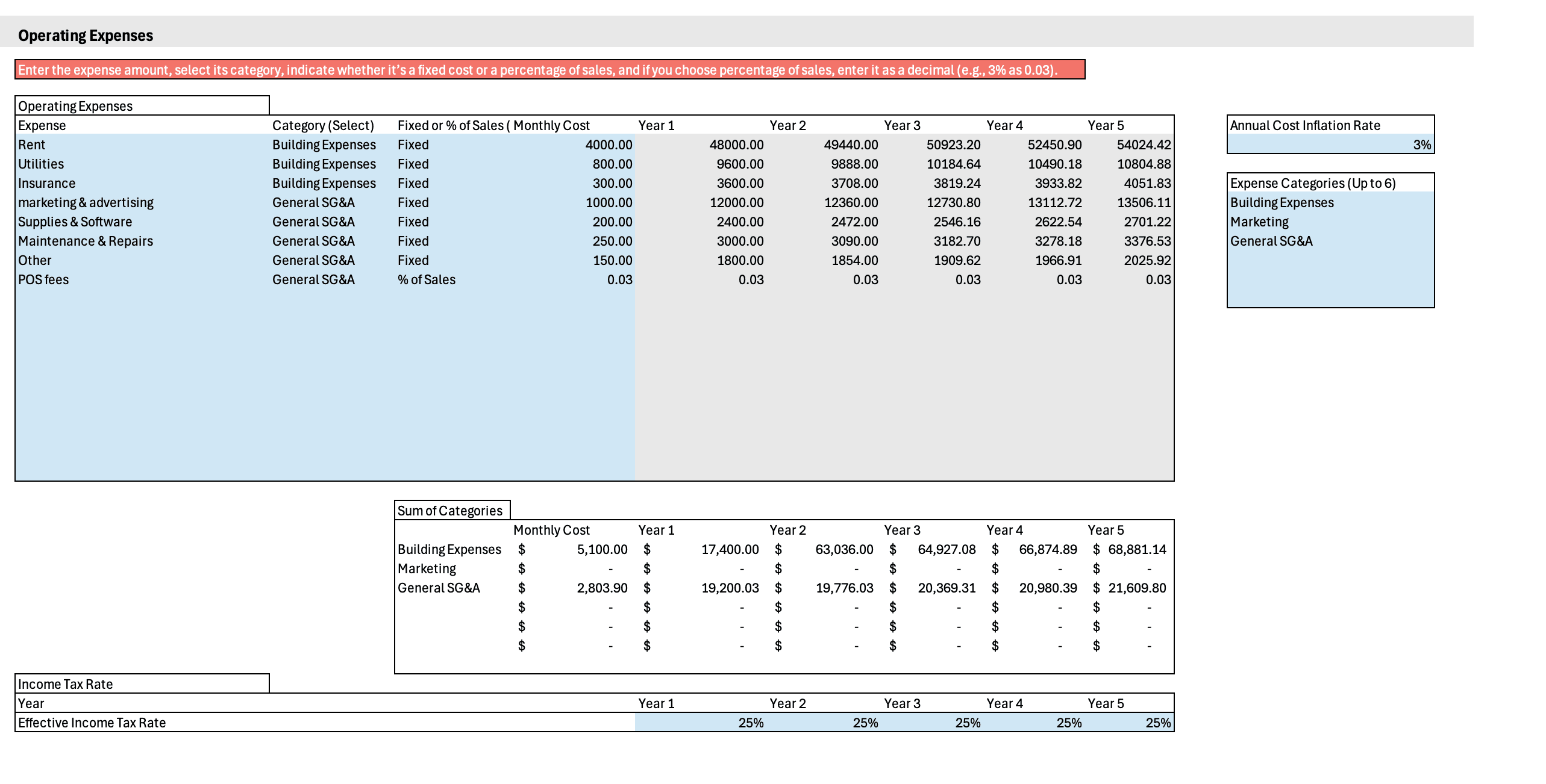

Recurring Cash Outflows to Model

Your cash flow projection should break down all expected cash outflows, both fixed and variable:

Labor & Payroll

Food truck labor costs include:

- Wages for cooks and cashiers

- Payroll taxes and benefits

- Overtime if peak shifts require it

Payroll is often paid weekly or biweekly, meaning cash leaves quickly, so timing matters in your projection.

Fuel, Repairs & Maintenance

Mobile businesses have fuel costs and periodic maintenance. These can fluctuate and should be modeled conservatively.

Permits, Licenses & Insurance

These can be annual or semi-annual payments but should be included in the monthly cash flow to avoid surprises.

Fixed Costs

Even though food trucks are mobile, there are recurring fixed costs like:

- Insurance

- Commissary fees

- Software subscriptions

- Marketing & promotions

Include these in your monthly cash outflows so you understand your cash burn rate.

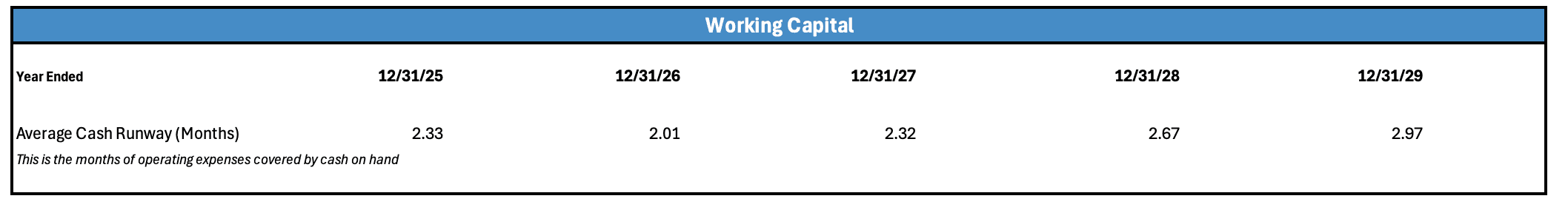

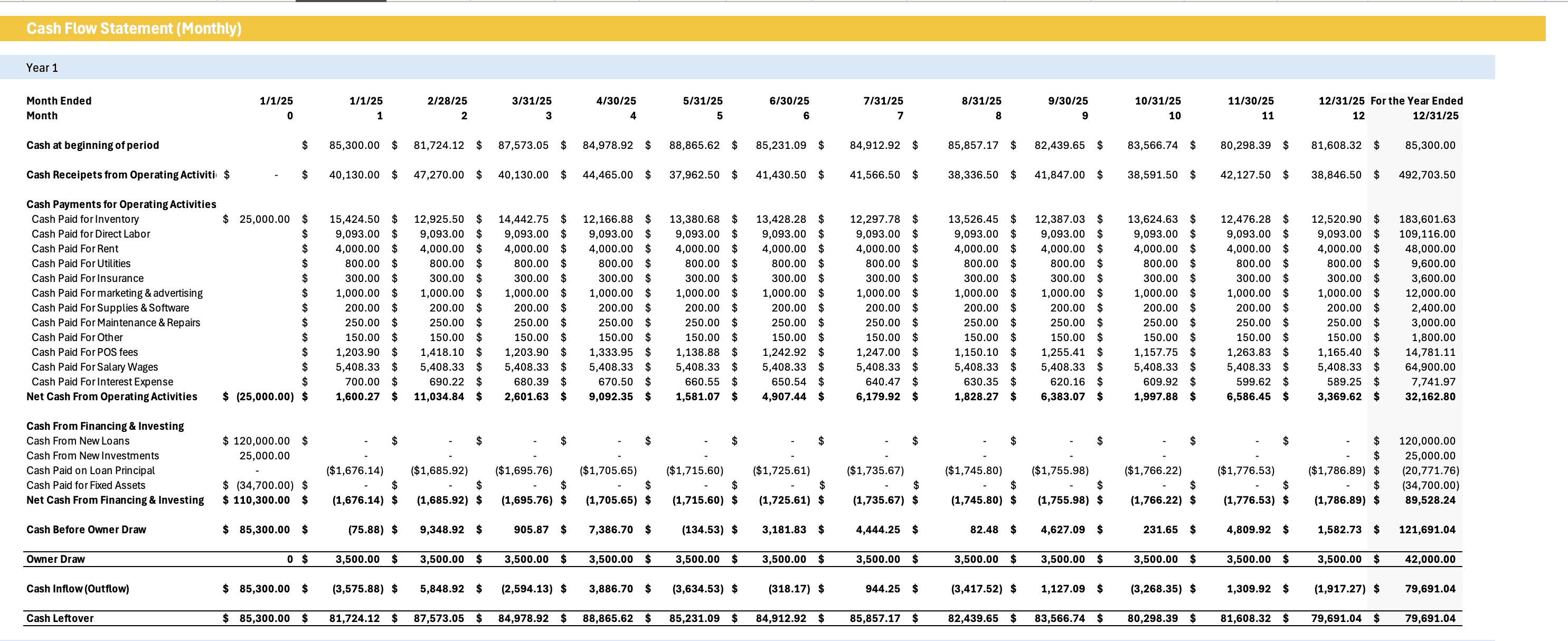

Projecting Cash Flow Month-by-Month

A typical cash flow projection for a food truck will list each month’s:

- Opening cash balance

- Cash inflows (sales, events, catering)

- Cash outflows (all expenses listed above)

- Net cash flow (inflows minus outflows)

- Closing cash balance

Closing balance from one month becomes the opening balance for the next, this helps you see when cash dips dangerously low or reaches positive territory.

When Does a Food Truck Become Cash Flow Positive?

A key goal of your projection is identifying the point when: Monthly cash inflows exceed monthly cash outflows, meaning the truck generates enough cash from operations to sustain itself.

For most food trucks, this happens after the initial ramp-up period, which can vary widely depending on location, marketing effectiveness, events booked, and customer demand. Your projection should clearly show this turning point so you know how long your initial funding needs to last.

Why Cash Flow Projections Matter in 2026

In 2026, costs like ingredients, fuel, and labor continue to rise, making cash flow planning more critical than ever. Lenders and investors also expect detailed, realistic cash flow projections as part of business plans and loan applications. A well-built projection shows that you understand your business and have planned for real-world challenges.

Final Thoughts

Projecting cash flow isn’t optional if you want your food truck to survive and grow. It forces you to think through startup costs, funding needs, daily operations, and realistic revenue expectations.

Even busy food trucks with great menus can run into trouble if cash flow is ignored. Detailed planning gives you control, flexibility, and peace of mind as you move from idea to open to scaling your mobile business.

Food Truck Financial Model / Projection Template Excel

Download the Template we used here!

Ready to Create Your Financial Model?

Get professional, investor-ready financial projections with our industry-specific templates. Save time and secure funding faster.

Browse Financial Models →