How to Project Cash Flow for a Coffee Shop (2026)

Before you open a coffee shop, one of the most important things you can do is project your cash flow. You can have great branding, a perfect location, and strong customer demand—but if you don’t manage cash properly, your business can still fail.

Cash flow is what determines whether you can pay rent, payroll, vendors, and loan payments while your shop ramps up.

Many coffee shops don’t fail because they’re unprofitable long term—they fail because they run out of cash early on. This guide walks through what you need to think about when projecting cash flow for a coffee shop in 2026.

What Cash Flow Means for a Coffee Shop

Cash flow is simply the movement of money in and out of your business.

- Cash inflows include drink sales, food sales, catering, and any other revenue.

- Cash outflows include rent, payroll, inventory, utilities, loan payments, and other operating expenses.

Your goal is not just to be profitable on paper, but to always have enough cash in the bank to operate. A coffee shop can show a profit on a monthly income statement and still be short on cash if timing, loan payments, or startup costs are not planned correctly.

Initial Investment and Loans

When projecting cash flow, the first place to start is your initial funding. This includes both owner investment and any loans you take out.

Startup Costs You Need to Cover

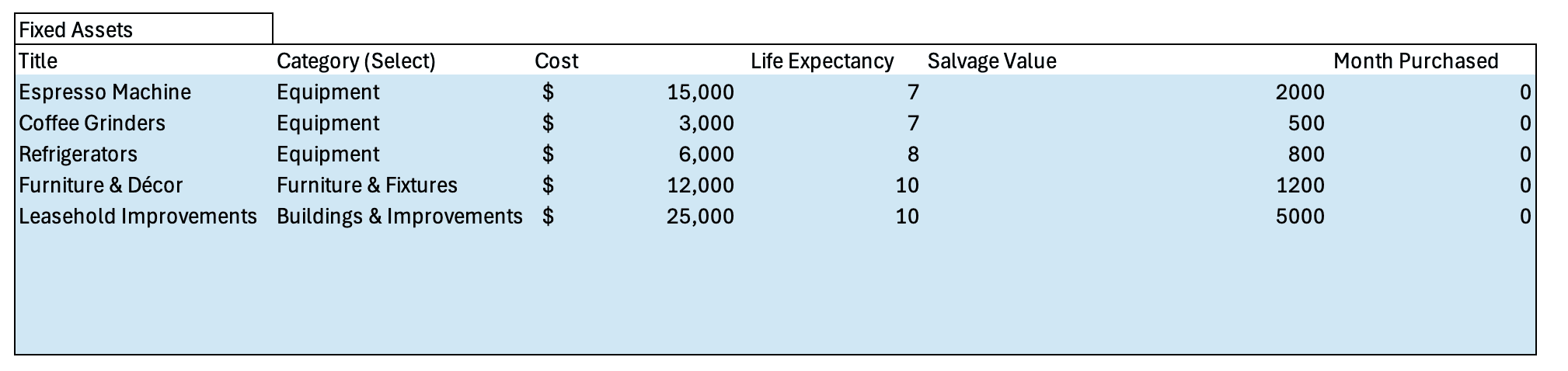

Your initial cash needs must cover more than just equipment and build-out. Common coffee shop startup costs include:

- Espresso machines, grinders, brewers

- Furniture and fixtures

- Build-out and renovations

- Permits, licenses, and inspections

- Initial inventory (coffee, milk, syrups, cups)

- POS system and software

- Pre-opening marketing

- Professional fees (legal, accounting)

Many new owners underestimate these costs or forget smaller items that add up quickly.

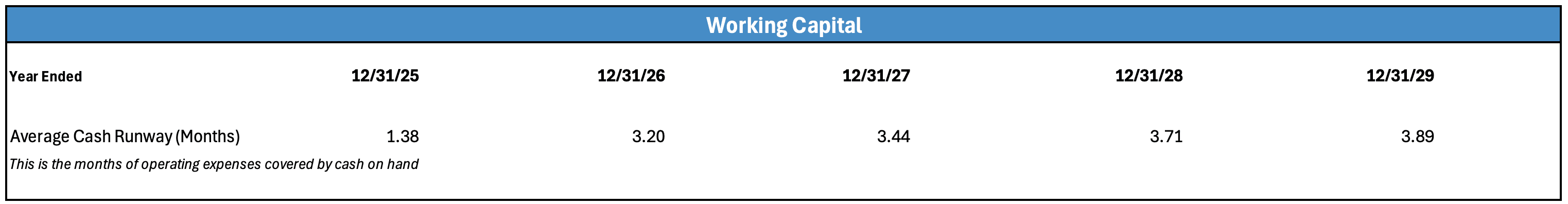

Cash Buffer Matters More Than You Think

In addition to startup costs, you need a cash buffer. This is money set aside to cover losses during the first several months of operation.

Most coffee shops do not generate positive cash flow on day one. Sales take time to build, but expenses like rent and payroll start immediately. Your projections should include enough cash to survive this ramp-up period without relying on emergency funding.

A good rule of thumb is to have 3–6 months of operating expenses in cash, depending on how aggressive your growth assumptions are.

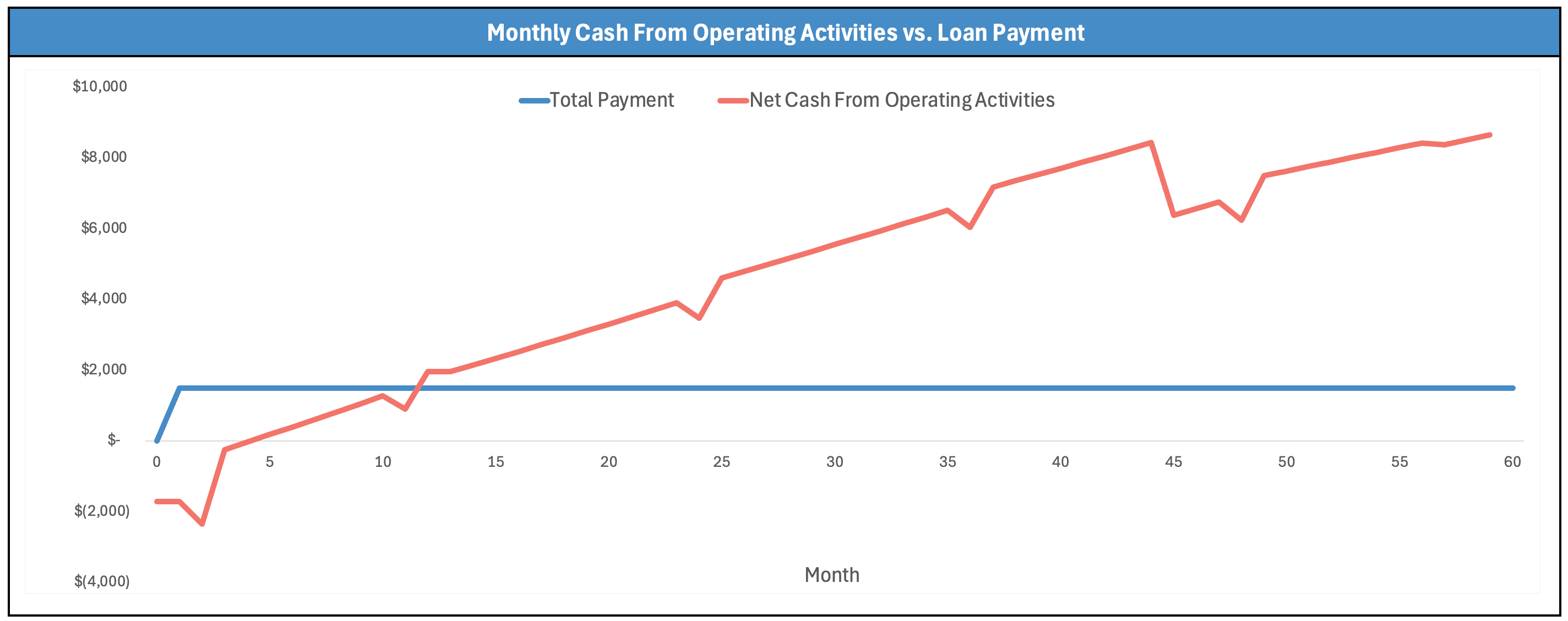

Loan Payments and Timing

If you are using an SBA loan or bank financing, your cash flow projection must account for:

- When loan payments start

- Monthly principal and interest payments

- Interest-only periods, if applicable

Even a profitable coffee shop can run into trouble if loan payments begin before revenue stabilizes. Cash flow projections help you see this risk ahead of time.

Revenue Assumptions: Be Conservative

Cash flow projections should be realistic, not optimistic.

When forecasting revenue, think about:

- Average tickets per customer

- Customers per day

- Seasonality (slower summers or winters depending on location)

- Ramp-up period during the first 3–6 months

It’s better to underestimate revenue and be pleasantly surprised than to assume best-case sales and run out of cash.

Day-to-Day Cash Flow Management

Once your coffee shop is open, daily cash flow becomes critical.

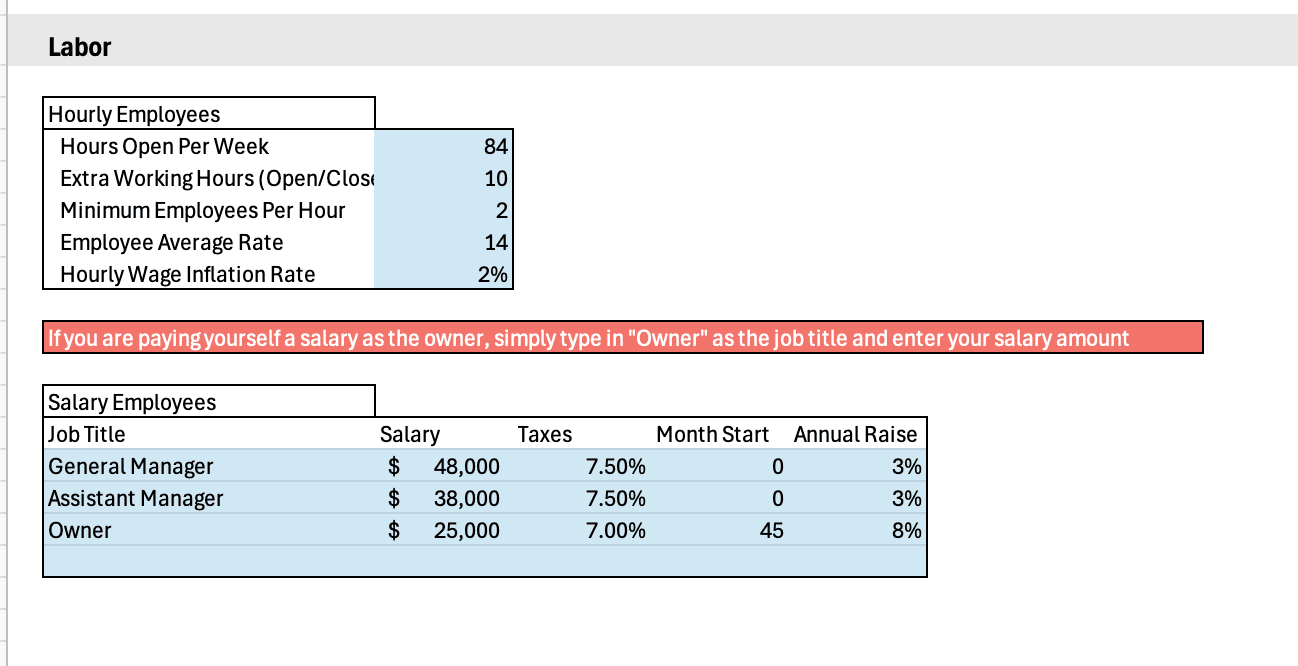

Payroll and Labor Timing

Payroll is usually the largest cash expense for a coffee shop. Your projection should include:

- Hourly staff wages

- Manager or owner salary

- Payroll taxes and benefits

- Overtime or schedule inefficiencies early on

Payroll often must be paid weekly or biweekly, which means cash leaves your account faster than revenue may come in.

Inventory and Vendor Payments

Coffee shops purchase inventory frequently, sometimes multiple times per week. You should project:

- Coffee bean purchases

- Milk and food restocking

- Paper goods and supplies

Some vendors require payment on delivery, while others offer net-15 or net-30 terms. These timing differences directly impact cash flow.

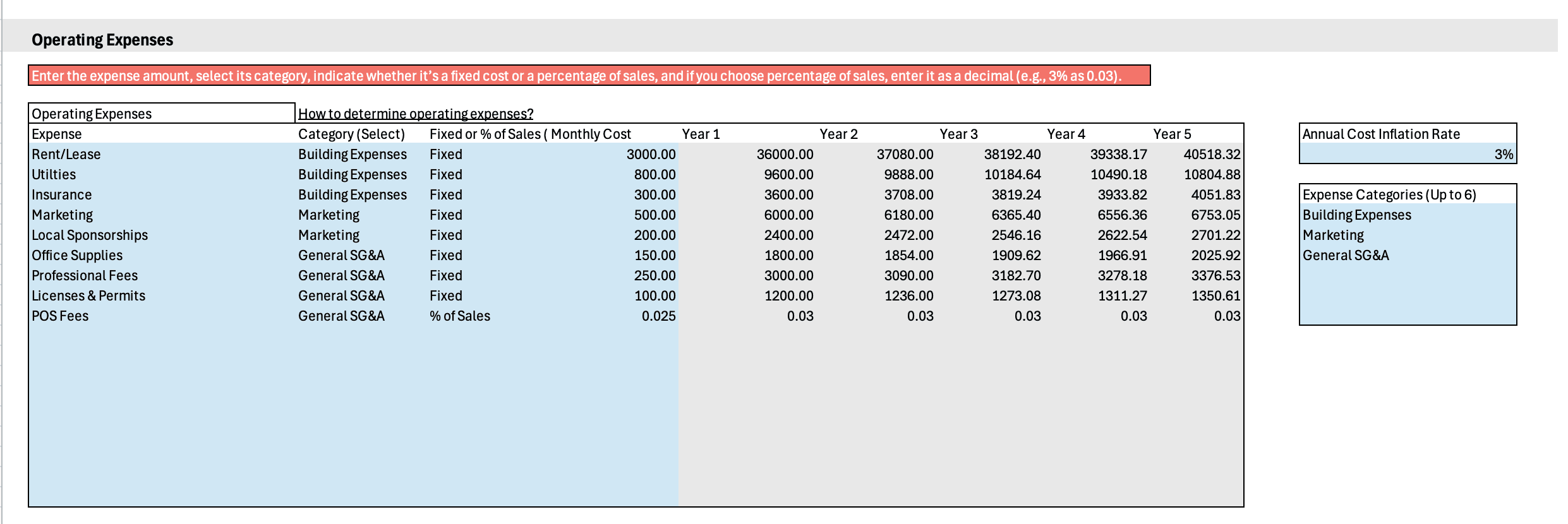

Rent and Fixed Expenses

Rent, utilities, insurance, and software subscriptions are fixed expenses that hit your bank account regardless of sales volume. Cash flow projections help ensure your daily sales can comfortably cover these costs.

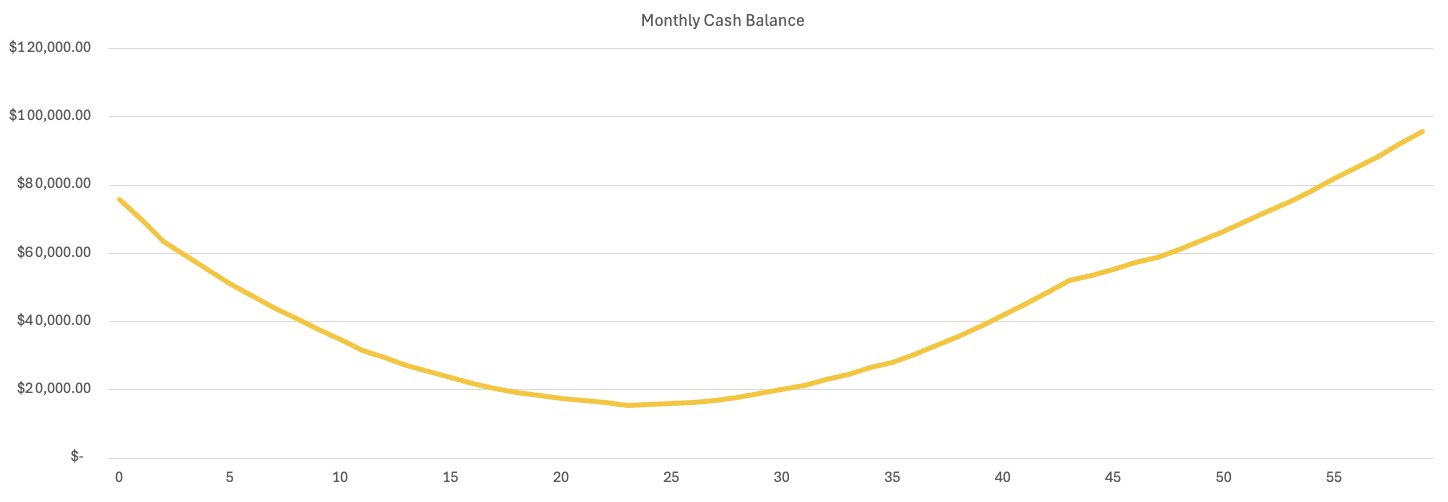

When Does a Coffee Shop Become Cash Flow Positive?

A key part of projecting cash flow is identifying when your shop turns cash flow positive.

This means:

- Daily and monthly cash inflows exceed cash outflows

- You no longer rely on startup cash to operate

For many coffee shops, this happens between month 3 and month 9, depending on location, pricing, staffing, and startup strategy. Your projection should clearly show this turning point so you know how long your initial funding needs to last.

Why Cash Flow Projections Are Critical in 2026

In 2026, costs are higher and margins are tighter than ever. Rent, labor, and ingredient costs continue to rise, making cash flow planning more important than in previous years.

Investors and lenders also expect more detailed projections. A well-built cash flow forecast shows that you understand your business and have planned for real-world challenges.

Coffee Shop Financial Projection Template Excel

Download our coffee shop financial projection template!

FAQs

How much cash should I have before opening a coffee shop?

Most coffee shops should have enough cash to cover all startup costs plus 3–6 months of operating expenses. This includes rent, payroll, inventory, utilities, and loan payments. Many coffee shops fail not because they are unprofitable, but because they run out of cash during the early months.

When does a coffee shop usually become cash flow positive?

A coffee shop typically becomes cash flow positive between 3 and 9 months after opening, depending on location, pricing, customer traffic, and labor efficiency. New shops often operate at a loss early on while building a customer base, which is why upfront cash planning is critical.

How should I forecast revenue for a coffee shop?

Revenue should be forecasted using realistic assumptions such as: Average ticket size, Customers per day, Operating days per month, seasonal fluctuations. It's best to start conservatively and build in gradual growth rather than assuming full capacity from day one.

Final Thoughts

Projecting cash flow is not optional if you want your coffee shop to survive and grow. It forces you to think through startup costs, funding needs, day-to-day operations, and realistic revenue expectations.

A coffee shop can be busy and still fail if cash flow is ignored. Planning ahead gives you control, flexibility, and peace of mind as you move from idea to opening day.

Ready to Create Your Financial Model?

Get professional, investor-ready financial projections with our industry-specific templates. Save time and secure funding faster.

Browse Financial Models →